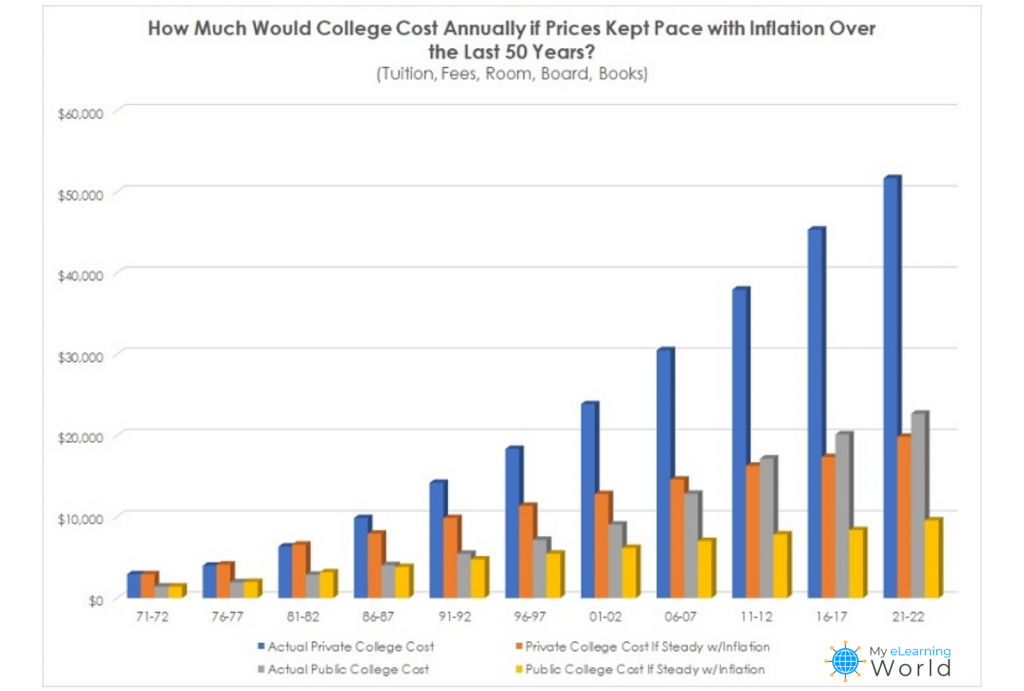

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students would be paying anywhere from roughly $10,000 to $20,000 per year to attend public or private universities respectively.

But as everybody knows, that’s certainly not the case.

According to data from the nonprofit group College Board, the average annual price for attending a public college (tuition, fees, room & board, books/supplies) is currently between $22,690 for in-state students to $39,510 for out-of-state students — in 1971, it was just $1,410 a year.

For students at private universities, the yearly cost has ballooned to $51,690 — in 1971, this was $2,930 per year.

That means the average cost of going to college has increased by as much as 2700% in some cases — about 4.6 times the rate of inflation during the last 50 years.

And there are some serious problems with this fact.

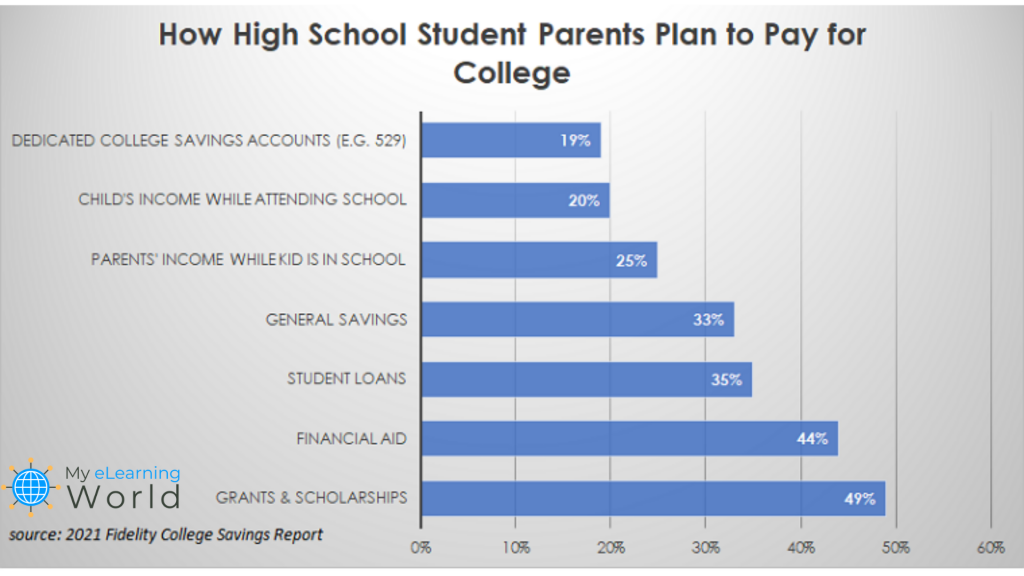

First, wages aren’t keeping up with inflation, making it harder for students and their families to afford the astronomical cost of college without getting buried in student loan debt. In fact, data suggests that for most workers, real wages haven’t grown much since 1970. In other words, wages after accounting for inflation have been mostly stable while college prices have skyrocketed.

Even worse, many families drastically underestimate the cost of college — with one recent Fidelity Investments survey showing that 1 in 4 parents and 38% of high school students think college costs $5,000 or less per year.

On top of all this, the value of a college degree has diminished over time.

In other words, the cost of a bachelor’s degree has increased to a point that it’s too expensive for many Americans to afford while also decreasing in value.

College Enrollment Declining, Students Turning Elsewhere

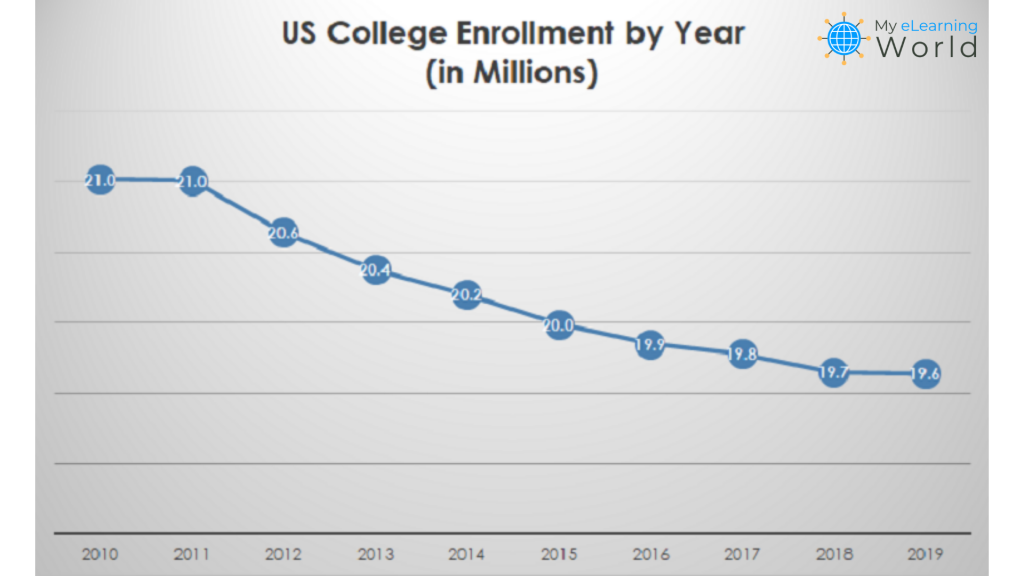

Perhaps not surprisingly, college enrollment has been declining steadily in recent years.

In fact, student enrollment at universities has decreased every year since 2011, thanks in large part to the soaring tuition and fees. This past spring semester saw one of the most dramatic declines in student enrollment yet of over 5% from the previous year as the pandemic undoubtedly compounded an already deteriorating situation.

And things don’t seem to be turning around in the fall semester.

According to data from the National Student Clearinghouse Research Center, “Fall 2021 enrollment numbers show no signs of recovery from last year’s declines. Undergraduate enrollment is down 3.2 percent from a year ago. Undergraduate student numbers have now fallen by 6.5 percent as a total from two years ago.”

Furthermore, many students have started to explore alternatives to the traditional college education, instead opting for online courses websites like Coursera, Udemy, Udacity, LinkedIn Learning, and Skillshare where they can get the knowledge and the skills they need from home and at a fraction of the price.

From mid-March to November 2020, the online learning platform Coursera reported seeing an over 300% increase in enrollments. And eLearning’s growth is expected to accelerate even more in the coming years.

“Since mid-March, we’ve had 24 million individuals register for the first time. That’s about 320% up from the same period a year ago,” Jeff Maggioncalda, CEO of online learning platform Coursera, told the BBC.

Will Online Learning Replace the Traditional College Experience?

College continues to become more expensive and enrollment to traditional universities is steadily declining with no end in sight. Meanwhile, online education is booming with enrollment numbers skyrocketing.

Does this mean that online learning is the future of higher education?

While the return on investment for a college degree has decreased over the years, higher education typically does still pay off for most graduates.

According to a new report from Georgetown University, high school graduates earn a median of $1.6 million during their lifetimes. Bachelor’s degree holders, on the other hand, earn a median of $2.8 million during their lifetimes.

But even though more education generally means more earnings, that’s not always the case as the report points out. Field of study, occupation, age, gender, and other factors can affect earnings and influence whether paying for college will actually be worth it.

The study points out that “16% of high school graduates, 23% of workers with some college education but no degree, and 28% of associate’s degree holders earn more than half of workers with a bachelor’s degree.”

“More education doesn’t always get you more money,” CEW Director and lead report author Anthony P. Carnevale said. “There’s a lot of variation in earnings related to field of study, occupation, and other factors.”

Online learning does offer some significant advantages over the traditional college model that put it into a unique position to perhaps one day overtake higher learning institutions.

Students learning online can put together a more flexible, varied curriculum more tailored to their interests in their career goals as there are practically infinite classes available.

And of course, there’s the flexibility to take these classes from anywhere in the world, and all at a fraction of the cost of attending college.

That said, employers in many fields still require degrees from traditional universities at this point and a certificate from an online school might not open as many employment opportunities at this point, depending on the industry.

But as online education continues to grow in popularity and college enrollment declines, could things change in the next 5, 10, 15, or 20 years? It’s a distinct possibility and something worth keeping a close eye on in the coming years.

As Ban Cheah, report author and CEW research professor and senior economist said, “Students need professional guidance on the economic outcomes of college and career pathways before they make one of the biggest decisions of their lives.

- Elevating Your Virtual Presence: Why EMEET’s SmartCam S800 Stands Out in Modern Communication - 06/04/2025

- US Teachers Will Spend $3.35 Billion of Their Own Money on Classroom Expenses in 2025-25 School Year - 06/04/2025

- Report: Leveraging AI Tools Could Help US Teachers Avoid $43.4 Billion of Unpaid Overtime Work - 06/04/2025