It’s no secret that college enrollment has been plummeting for years now, and the problem has only worsened since the pandemic. And while there might be some signs that the enrollment decline is temporarily starting to slow a bit (more on why it’s only “temporarily” later), enrollment is still projected to be down year over year for the Fall 2023 semester.

As Fortune magazine explained, “The slide in the college-going rate since 2018 is the steepest on record, according to the U.S. Bureau of Labor Statistics.”

The most commonly cited reason young adults are skipping out on college? They say it’s become too expensive.

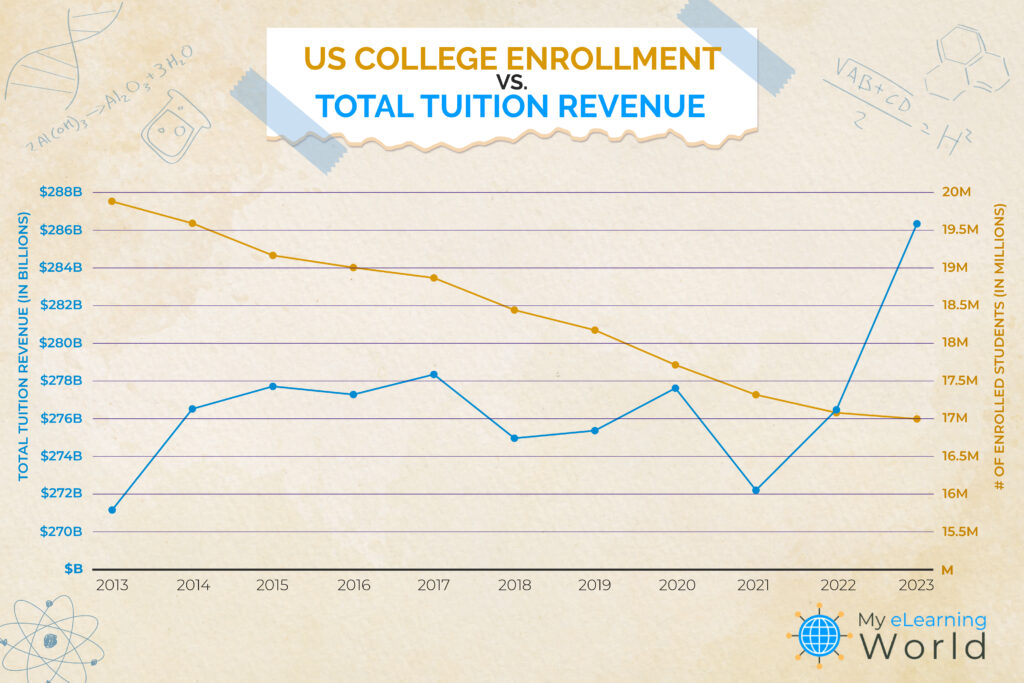

On the surface, it sounds like colleges are facing a crisis as they have fewer students paying to attend than at any time in recent history, but would you believe it if we told you that universities are actually raking in more in total tuition revenue than ever before?

We’ve crunched the numbers and our analysis found that even though college enrollment has dropped by an astonishing 14.4% since 2013, colleges and universities are still bringing in 5.6% more in overall tuition revenue from students.

By the Numbers

According to data from the National Student Clearinghouse Research Center (NSCRC), in fall 2013, total enrollment across all two and four-year universities totaled 19.9 million students. Jump ahead a decade and our estimates for the fall 2023 semester show that number has dropped all the way to 17 million — a loss of 2.9 million enrolled students in a 10-year span.

Here’s a look at total fall semester enrollment numbers over the last decade (includes enrollment at public two-year community colleges, public four-year universities, and private four-year universities):

- 2013–19,885,203

- 2014–19,619,773

- 2015–19,280,473

- 2016–19,010,459

- 2017–18,811,280

- 2018–18,482,391

- 2019–18,239,874

- 2020–17,778,484

- 2021–17,302,364

- 2022–17,112,038

- 2023–17,026,478

With nearly 3 million fewer paying students, you’d think this decline would cause a significant decrease in revenue, but in reality, the opposite has happened.

We found that total annual revenue for US colleges from tuition and fees has increased by at least $15.2 billion over the last decade.

We arrived at this figure by studying student enrollment data from NSCRC for the past 10 years across all sectors — community colleges, public universities, and private universities. We then analyzed the College Board’s historical tuition data by year for each of those sectors.

By combining the two data sets and using our estimations for Fall 2023 figures based on current data and recent trends, we were able to see exactly how the enrollment decline impacted total tuition revenue for colleges and universities.

- Community colleges–In 2013, two-year colleges had an average tuition of $3,590 for a full school year, pulling in $22.7 billion in revenue from 6.3 million enrolled students. In 2023, community college tuition has only increased a bit to an estimated $4,014 per year, for a total of $18.8 billion in tuition revenue (4.67 million students). What’s interesting to note is that two-year colleges are the only type of university to lose tuition revenue over the last decade.

- Public universities–In 2013, four-year public universities had an average in-state tuition of $9,860 for a full school year, pulling in at least $78.5 billion in revenue (likely higher as out-of-state tuition rates are higher, but data on enrollment numbers for in-state vs out-of-state was unavailable for the nearly 8 million total students). In 2023, public university tuition at four-year schools jumped to an estimated $11,378 per year, for a total of at least $86.5 billion in tuition revenue (7.6 million students).

- Private universities–In 2013, private universities had an average tuition of $33,420 for a full school year, pulling in $169.9 billion in revenue (5.1 million students). In 2023, tuition fees for four-year private universities increased to $40,976 per year according to our estimates, for a total of $181.1 billion in tuition revenue (4.4. million students).

Do Colleges Lack an Incentive to Lower the Cost of Tuition?

Typically, if a business’ customer base shrank by more than 14% in a decade because its product was too expensive, that business would be scrambling to lower prices to stop the bleeding. But this isn’t a typical situation, and that’s not what we’ve seen happen in the higher education landscape.

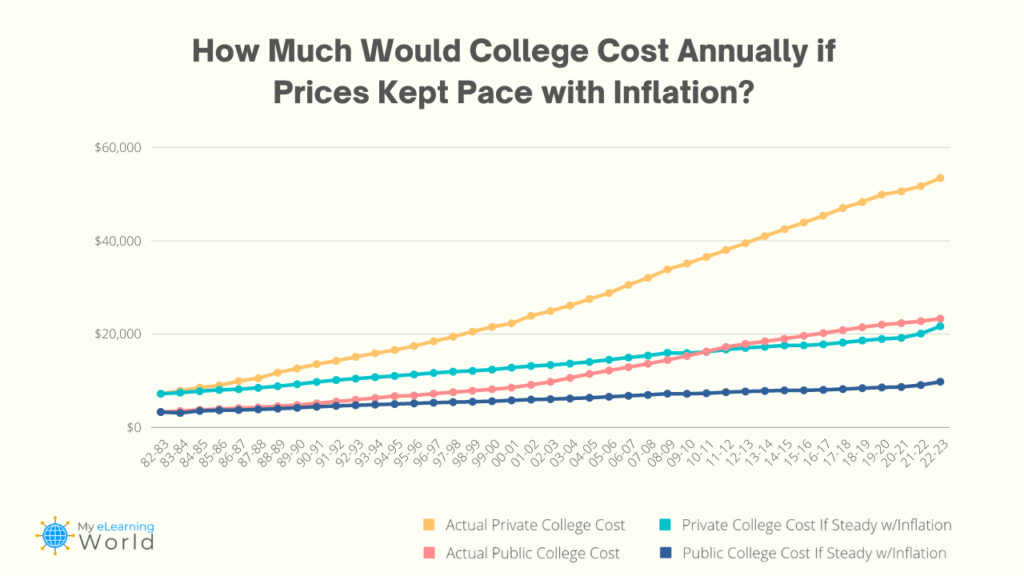

As we’ve previously reported, the cost of going to college has gone up by about 3 times the rate of inflation over the last 40 years. These massive tuition fees have caused many college-aged individuals to think twice about enrolling in school.

But as our analysis found, despite a decline in college enrollment universities are raking in more revenue than ever before.

This paradox prompts a critical question: Do colleges have any real incentive to lower their tuition rates?

Only time will tell, but as more and more would-be students continue to get priced out, you can’t help but wonder if colleges will eventually have to do something about their tuition fees and try to turn around the drop in enrollment.

The real problem colleges will soon face is that the number of college-aged Americans is about to start declining steeply and quickly. American birth rates started dropping significantly in 2007 and have steadily declined over time. That means that starting in 2025, there will be fewer potential students for colleges to attract.

Meanwhile, numerous young adults are choosing to pursue career training through online learning platforms such as Coursera, Udacity, and edX, all at a fraction of the expense associated with college education, albeit without the accompanying prestigious degree.

Maybe schools will eventually strike the right balance between tuition fees and enrollment figures, but until that happens, it’s likely that the trend of declining enrollment will persist.

- Elevating Your Virtual Presence: Why EMEET’s SmartCam S800 Stands Out in Modern Communication - 06/04/2025

- US Teachers Will Spend $3.35 Billion of Their Own Money on Classroom Expenses in 2025-25 School Year - 06/04/2025

- Report: Leveraging AI Tools Could Help US Teachers Avoid $43.4 Billion of Unpaid Overtime Work - 06/04/2025