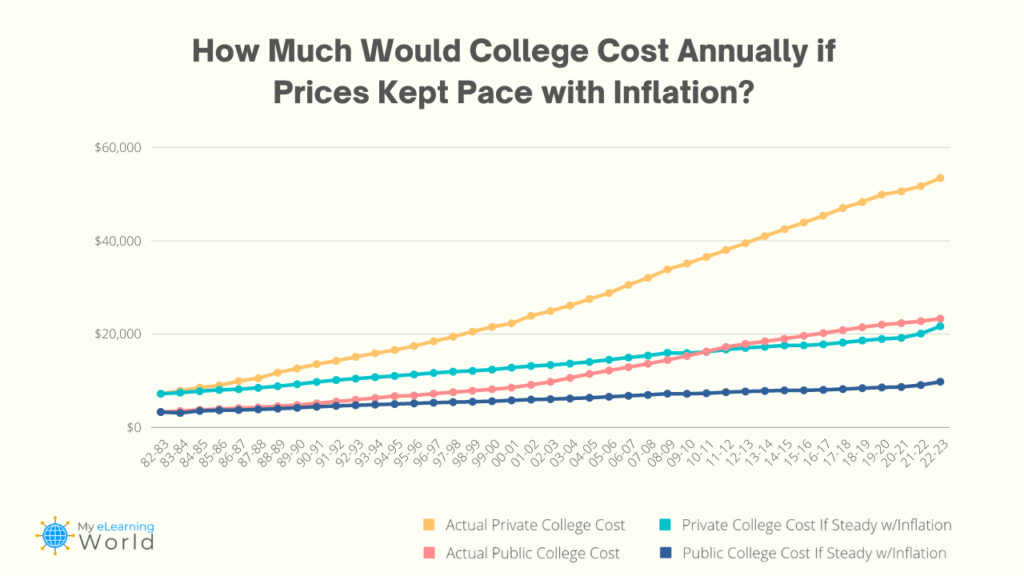

If the cost of going to college rose consistently with the U.S. inflation rate over the last 40 years, students would be paying an average of $9,705 for a full year of attending a public university or $21,623 for a year at a private college.

Needless to say, that’s not the case.

Data from the nonprofit group College Board reveals the average annual price for attending a public college (tuition, fees, room & board, books/supplies) is currently between $23,250 for in-state students to $40,550 for out-of-state students — in the 1982-83 school year, it was just $3,200.

For students at private universities, the yearly cost has reached a jaw-dropping $53,430 — in 1982, this was $7,130 per year.

In other words, the cost of going to college has increased by as much as 649% in some cases — over 3 times the rate of inflation during the last 40 years.

A Turning Point

Why are we focusing on the last 40 years in particular?

Because when you look back at the historical data on tuition costs, the 80s were a significant turning point.

Between 1980 and 1990, the cost of going to college basically doubled — rising 141% for private universities and 99% for public colleges.

The 1980s decade saw some of the biggest year-over-year tuition increases of any decade.

| Academic Year | Private College Tuition & Fees | Public College Tuition & Fees |

| 80-81 | $5,590 | $2,550 |

| 81-82 | $6,330 | $2,870 |

| 82-83 | $7,130 | $3,200 |

| 83-84 | $7,760 | $3,430 |

| 84-85 | $8,450 | $3,680 |

| 85-86 | $8,900 | $3,860 |

| 86-87 | $9,850 | $4,050 |

| 87-88 | $10,460 | $4,200 |

| 88-89 | $11,660 | $4,460 |

| 89-90 | $12,560 | $4,720 |

| 90-91 | $13,480 | $5,070 |

In 1986, William Bennett, the Secretary of Education, sounded the alarm on the rising costs of college, accusing institutions of “defrauding students [and] ripping off the American public” and warning that the fast-rising default rate on student loans was unsustainable.

Unfortunately, the trajectory of increasing tuition and fees that started 4 decades ago has continued to this day.

College Enrollment is on the Decline

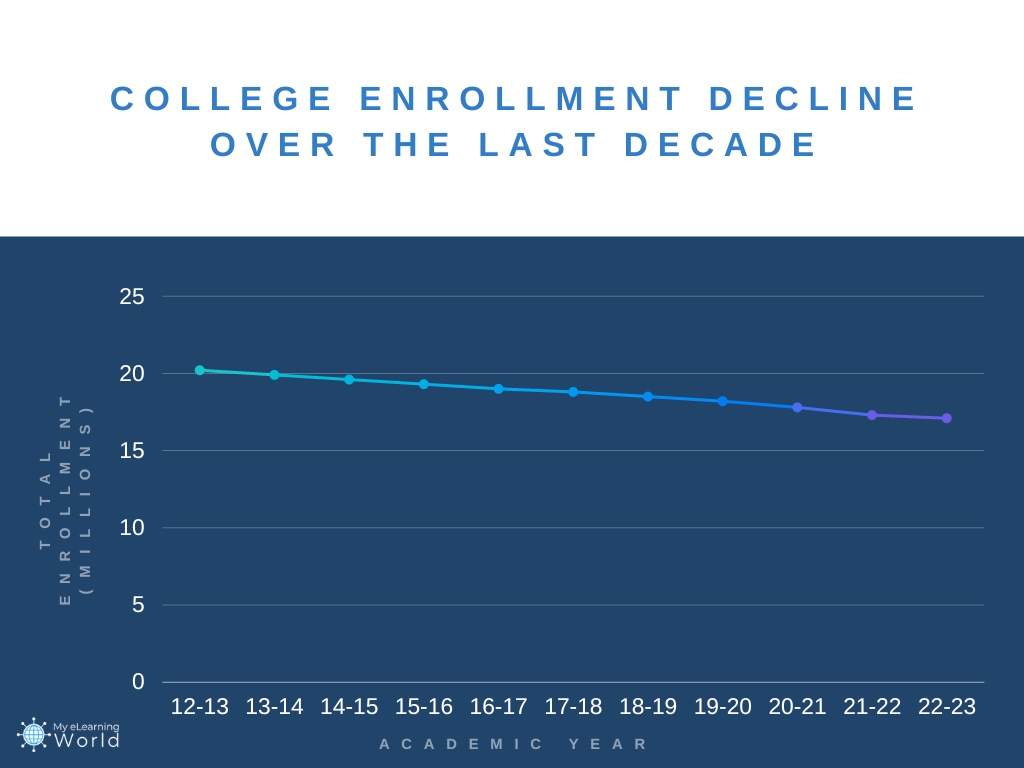

As the cost of going to college has soared, many young adults have simply started to opt out of attending.

We recently reported that enrollment across all two and four-year universities dropped by 3.1 million students from 2012 to 2022.

However, tuition prices have risen so much during that same 10-year period that total annual revenue for US colleges from tuition and fees actually increased by at least $6.9 billion.

At the same time, some students have started to explore alternatives to the traditional college education, turning instead to online courses websites like Coursera, Udemy, Udacity, LinkedIn Learning, and Skillshare where they can take online certificate courses from schools like Harvard and Yale at home and at a fraction of the price (or even free in some cases). Many of these online course sites like Coursera have reported huge increases in enrollments over the last couple of years.

Worrisome Trends Show No Sign of Reversing

Unfortunately, the trend of rising tuition costs and student debt for traditional college education shows no signs of reversing.

Today, the average college graduate leaves school with about $31,100 in student loan debt they’ll have to pay back. The latest data shows that U.S. student loan debt totals about $1.76 trillion.

And as we recently reported, it’s no longer realistic for students to work their way through college with decades of stagnant wages during a time of astronomic spikes in tuition and fees.

Eventually, something has to give. The future of higher education might depend on it.

- Elevating Your Virtual Presence: Why EMEET’s SmartCam S800 Stands Out in Modern Communication - 06/04/2025

- US Teachers Will Spend $3.35 Billion of Their Own Money on Classroom Expenses in 2025-25 School Year - 06/04/2025

- Report: Leveraging AI Tools Could Help US Teachers Avoid $43.4 Billion of Unpaid Overtime Work - 06/04/2025